Links

AT&T Where To Go For More Information Guide 2024

LIFE INSURANCE & DEATH BENEFIT CHANGES

AT&T met with TELCO RETIREES ASSN Retirees Assn in December to tell us about a planned change: reduction in benefits.

1. Former managers impacted by: Life Insurance moving to a flat $15,000 + Retirement Death Benefit capped at $25,000

2. Former managers impacted by: Life Insurance moving to a flat $15,000 (no Retirement Death Benefit)

3. Former bargained employees impacted by: Life Insurance capped at $25,000 + Retirement Death Benefit capped at $25,000

4. Former bargained employees impacted by: Life Insurance capped at $25,000 (no Retirement Death Benefit)

TELCO RETIREES ASSN with other retiree organizations sent a letter to AT&T Executive Management requesting reconsideration and questioning the legality of including Grandfathered retirees. This is posted on our website www.telcoretirees.org under Benefit. Our Board member, Ted Mazzella, sent documentation to AT&T supporting our position. They agreed.

End Result: GRANDFATHERED RETIREES WILL NOT BE INCLUDED IN THIS BENEFIT REDUCTION. THEIR CURRENT LIFE INSURANCE AND DEATH BENEFITS WILL REMAIN UNCHANGED.

Unfortunately, all other retirees are subject to the reductions. TELCO RETIREES ASSN’s Board looked for other legal alternatives. We received assistance from NRLN (National Retirees Legislative Network) seeking other cases filed and their outcome. Lawsuits filed by Lucent and other retiree groups affiliated with NRLN were unsuccessful. These cases were individually filed for Death Benefit and Life Insurance benefits. Our Lucent/Avaya counterparts had their benefits eliminated or reduced many years ago. The cases were unsuccessful. The Courts have found that Life Insurance and death benefits, as well as, health care are not protected under ERISA and therefore, AT&T has the right to reduce or eliminate these benefits. The only exception is if you retired prior to AT&T inserting a ROR (Reservation of Rights) into the retirement plans. Because of the number of different companies, mergers, acquisitions, etc. there is no specific date but it is usually 1990 and earlier. This is the exception that applies to Grandfathered retirees.

Special thanks to our Board Members, Ted Mazzella and Carole Hansen, who found and forwarded documentation from the 1980s.

If you are a GRANDFATHERED RETIREE and have documentation from retirement prior to 1991, please contact us so we can maintain an ongoing library. It may save you a lot of money.

Send to TKMAZZ@verizon.net, 845-359-5874.

December 31,2020

Ms. Angela Santone

Senior Executive Vice President HR

AT&T

208 S. Akard Suite 3703

Dallas, TX 75205

Dear Ms. Santone,

As AT&T retirees we are compelled to express our shock and dismay at AT&T’s announcement regarding retirement life insurance benefits. It is truly amazing that at the height of the worst pandemic our country has ever experienced, with over 300,000 people who have already died, AT&T would inform retirees that they are cutting and or eliminating life insurance and death benefits for retirees. Does that say something about how retirees, your so called “ambassadors” are regarded by their former employer?

It is quite interesting that the explanation provided is not that this is a steep burden on AT&T during difficult financial times but rather that AT&T is making these changes to be closer to the “market”. AT&T was once the “market” leader.

When most retirees were hired, in many cases their salaries were less than “the market” because they were offered “exceptional benefits” to compensate. At retirement retirees were assured by many corporate leaders of receiving these benefits, both verbally and written. Now the “new AT&T” has had a change of heart. Evidently this is not a case where your word is your bond.

It is also our understanding that “Grandfathered” retirees have legal protection under the Reservation of Rights clause. Have you thoroughly evaluated your obligations in this area? We feel strongly that “Grandfathered” retiree provisions regarding Life Insurance and the Death Benefits should be made whole.

It also appears that AT&T has mindfully chosen to differentiate between union and management retirees. We have to ask why? What makes one class of retirees more valuable than another?

Retirees of both union and management from our organizations, have a long history of pride, loyalty and respect for AT&T. They are shareholder as individuals as well as members of our retiree groups which also own AT&T stock. They have defended the company to friends and neighbors, written letters and called their Senators and Congressional representatives when asked to do so by AT&T. But respect and loyalty is a two-way street.

There has been an erosion of benefits over the last decade since AT&T has made “super deals” that have cost the shareholders, as well as retirees. Retirees really feel the pinch when benefits are cut or reduced. Why is this necessary? What is the true savings to AT&T?

It would seem that at this time, in our nation, when the need for assistance is so great that AT&T would again want to take a leadership role in helping and protecting some of the most vulnerable, including your own retirees. We encourage you to examine the disparities of this decision and reconsider the changes you have suggested before implementation.

Sincerely,

JoAnn Alix-Gagain, President

SNET Retirees Assoc, Inc.

318 Central Rd Middlebury, CT 06762

Monte Baggs, President,

Telco Retirees Association, Inc.

PO Box 669, Spring Valley, CA. 91976

Jane Banfield, VP

Telco Retirees Association, Inc.

PO Box 669, Spring Valley, CA. 91976

Carole Lovell, President

AASBCR®

P.O. Box 110355

Cleveland, OH 44111-0355

CC: John Palmer Senior Vice President

Julianna Galloway Vice President

CARES ACT AND HOW IT AFFECTS YOUR RETIREMENT SAVINGS

Fellow Retirees:

On March 27, 2020, the Coronavirus Aid, Relief and Economic Security Act (CARES Act) was signed into law. While the Association cannot offer your financial advice or recommendations, we believe sharing news of the federal CARES Act, and how it can possibly impact you and your family, might be of value to our members and their families.

While this law covers many aspects other than retirement plans, the immediate effects on retirees and our retirement savings plans are as follows:

Coronavirus Related Distributions

Coronavirus Related Distribution is available to any eligible plan participant who meets any of the below criteria:

Diagnosed with SARS-CoV-2 or Covid-19 by a test approved by the Centers for Disease Control and Prevention (CDC).

Any of the immediate family members such as spouse or dependents have been diagnosed with SARS-CoV-2 or Covid-19 by a test approved by CDC.

Who experiences adverse financial consequences as a result of being quarantined, furloughed, laid off, or having work hours reduced due to such virus or disease, closing or reducing hours of business owned or operated by the individual due to such virus or disease.

Other factors as determined by the Treasury Secretary.

The participant’s statement would have to be taken in regards to whether the participant qualifies for a Coronavirus Distribution.

These distributions will have certain requirements:

The maximum amount that can be requested for a distribution is $100,000 per tax year. This distribution window ends on December 31, 2020.

20% withholding will not occur at the time of distribution and is not eligible for rollover.

The taxes on the distribution can be paid at the time of distribution or spread over 3 years by the plan participant.

If participant is under age 59 1/2 then the early withdrawal 10% penalty will not apply.

The amount of the distribution can be replenished back by the participant within a 3-year time frame if desired so that their retirement savings is not diminished.

Participant Loans

There are 2 available loan reliefs being provided:

New Loan

If the plan allows for loans the plan participant can take a maximum loan in the amount of $100,000 or 100% of their vested account balance. The duration of the loan would be for 5 years.

Suspending existing outstanding loan repayments

If a participant requests to suspend their loan repayments, then a plan sponsor will be able to suspend their loan repayments for 1 year. The request to suspend loan repayment needs to be made by the participant by December 31, 2020.

The 1-year suspension of loan repayments is added to the original loan term and interest continues to accrue regardless of the length of the loan’s original term.

This would apply to all plan participants even if they were furloughed or temporarily considered laid off.

Both the Coronavirus related distributions and loan relief is optional, and the plan trustee would need to allow it in the plan. If the above relief is offered an amendment to the plan document will be required to be adopted by the last day of the plan year beginning in 2022. Example December 31, 2022 for a calendar year plan.

Required Minimum Distribution (RMD) for 2020

With all the turmoil in the stock market we have got good relief of not mandating the participant to take an RMD distribution for 2020. Under the SECURE ACT as you may know the minimum RMD distribution age has increased to age 72 in 2020.

An RMD Distribution will not be required in the following instances:

Participant who reached 70 1/2 prior to 2020 will be exempted and not required to take a RMD distribution for 2020.

Participant who reached 701/2 in 2019 and who has not taken his/her first RMD for 2019 by December 31, 2019 will not have to receive their first (2019) RMD or their 2020 RMD.

Participants who reach 72 in 2020 will be exempted to take their 2020 RMD.

Beneficiaries receiving life expectancy payments will not be required to receive 2020 beneficiary RMD. If the beneficiary was using the 5-year distribution rule then in essence the beneficiary will now have 6 years to cash it out from the time of the participant’s death.

The full text of the new law can be found here: https://www.congress.gov/bill/116th-congress/senate-bill/3548/text#toc-H638004C502804947B4CFB9B4B770C2F2

Please do not contact the Association for financial, or tax advice. We recommend you contact your specific plan administrator or tax and financial advisor for further information or guidance.

Dear Members,

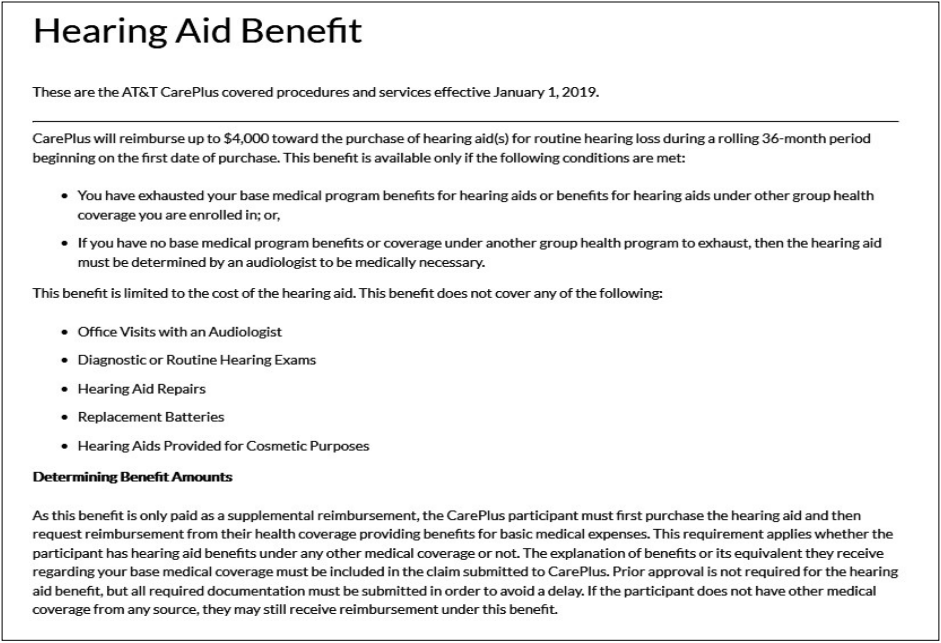

This mini newsletter corrects a glitch in the 3rd quarter newsletter concerning the maximum

reimbursement for hearing aids under the Care Plus plan. The reimbursement was portrayed

as $1,000, but as of January 2019 it was actually $4,000 and should have been shown as such.

We apologize profusely for the confusion.

The verbiage from the Care Plus SPD is printed below.

June 21, 2017

Attention All Members:

Following is an important reminder from AT&T regarding Fidelity and Life Insurance Beneficiaries…..

A campaign was recently launched to encourage participants to update their beneficiaries on-line. The on-line access allows participants to easily check and update their beneficiaries periodically. The on-line beneficiary forms were available beginning in 2011 to provide more transparency to the participants. The recent campaign was to serve as a reminder of the benefits of having the on-line access. However, the old paper forms are archived and still available. Therefore, in researching beneficiaries, Fidelity will first check on the on-line system. If the information is not available on on-line, then the archives are searched for the paper forms.

Please assure the participants that their beneficiary forms are still available either on-line or archived paper forms.

For information on who to contact at AT&T for various reasons, please use the following link:

https://cache.hacontent.com/ybr/R516/03349_ybr_ybrfndt/downloads/ODOC7839607.pdf

After reaching the web site, please scroll down to the table of contents to find your area of interest.

A Note from Your Vice President Regarding Grandfathered Retirees

For retirees who are grandfathered on AT&T’s healthcare plans, the information and links shown below are valid and accurate.

For retirees that moved to Aon/Hewitt healthcare exchange in 2015, you will need to use their web site located at www.aonhewittnavigators.com to manage your healthcare and HRA issues.

AT&T Corporate Links and Information

AT&T Corporate Contacts page

Click Here

*Access AT&T, Inc. *NOTE THIS IS A PASSWORD PROTECTED LINK

Click Here

Summary Plan Descriptions

Health Care

P.O. Box 30557, Salt lake City, UT 84130-0557

Pre-certification – 1-866-705-9767

Pensions

P.O. Box 770003, Cincinnati, OH 45277-0065

1-800-416-2363

Prescription Drugs

P.O. Box. 6590, Lee’s Summit, MO,64064-6590

Vision Service Plan

4000 Luxottica Place, Mason, OH 45040-7111

1-800-638-4288

Savings / Security Plans

P.O. Box 770003, Cincinnati, OH 45277-0065

1-800-416-2363

Care Plus

P.O. Box 30557, Salt Lake City, UT 84130-0557

1-877-261-3340

Cigna Dental

P.O. Box 188040, Chattanoga, TN 37422

1-888-722-5505

Employee and Retiree Sales & Service Center

Death Benefits

1-800-416-2363

Life Insurance

4 Overlook Point, P.O. Box 1474

Lincolnshire, IL 60069-1474

1-877-722-0020

Retirees Wireless Discount Center

Request for Copies of Documents

Attn: Plan Documents

P.O. Box 132160, Dallas, Texas 75313-2160

1-800-722-0020

Other Retirement Association Links

NRLN

http://www.nrln.org

US West Retirees

http://www.uswestretiree.org

Verizon Retirees

http://www.belltelretirees.org

NECA-IBEW

http://www.neca-ibew.org

ACER Website

http://www.att-retirees.org

AASBCR (Association of Ameritech/SBC Retirees

http://www.aasbcr.org

SNET (SRA)

http://www.snetretirees.org

Locate and contact your Congressional Representative

Congressional Representatives

http://www.usa.gov

If you choose to select one of the above links, you will access a third party web site. TelCo Retirees Association, Inc. provides these links as a convenience to and as a reference for you. This is not an endorsement by TelCo Retirees Association, Inc. of the contents of these third party web sites. TelCo Retirees Association, Inc. is not responsible for the content of third party web sites and The TelCo Retirees Association, Inc. makes no representations or warranties regarding the content or accuracy of materials on third party websites. If you decide to access the third party website, you do so at your own choosing and risk.